Our Methods

Archetipo srl can also offer its advice in the field of real estate evalutation, providing technical consideration and recommendations on housing of all kinds, based on the following methods:

|

Comparative method: this approach consists in determining the selling price of a given accommodation trough a detailed analysis of the average selling value for comparable in a specifi Area, on which the reference property is allocated. After viewing the accommodation, based on the cadastral map, we measure the Surface, both walkable and commercial. Therefore, after determining the average unit price of the specific area, taking into account the main characteristics of the property in question, we establish the probable selling price, also considering the discounts (especialy if it were used) most likely to offer. *Click on Graph A |

|

|

Income Approach: with this metod we take care to evaluate, in percentage terms, the income net of expenses, taking into account the various parameters: the purchase value of the property net of VAT, any costs to be incurred, such as property, administrative, insurance, agency/marketing, rent revenues (net of coupon tax, and IMU + TASI). With this approach, therefore, we indicate the net return, as well as the ROI ( Return on Investiment), on a given investment property. In addition, we also evaluate the annual profit, net of any expenses. *Click on Graph B |

|

|

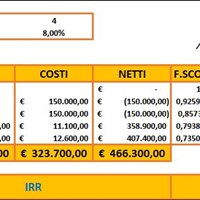

Financial Method - Cash flow (relevant for the valutation of building areas and buildings to be restored): With this method we can estimate both the value of a certain property to be developed in a building area, both the value of a building (shed, building...) to be restored, during a certain period of time. By discounting cash flows over time and at a given Discount Rate, we can determinate the likely value of the property to be built or renovated at a future date. In addition, we can determinate the Internal Rate of Return (TIR o IRR), also defined the Discount Rate, that is the rate that makes the net present value of a series of cash flows equal to 0. As a result, trough this specific parameter, we can estimate the possible net return of a given set of cash flow for a sspecific real estate investiment . *Click on Graph C. |

|

|

|

|

|

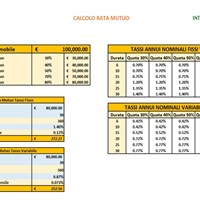

Mortgage Calculation: taking into account the fixed and variable rates of certain banks, we can establish the monthly instalments of the loan, taking into account the shares of the loan on the value of the proprety, the duration of the bank loan and the interest rate, fixed or variable. The rate is selected based on the relationship between the share and the duration of the loan. *Click on Graph C |

| OUR EVALUATIONS |

| REQUEST A QUOTE |